We certainly live in confusing times. Years ago there was a clear demarcation between capitalism and communism. Today, this difference is getting blurred. Communist China has emerged as a country with the most florid capitalistic system. On the other hand, capitalistic countries, like the U.S., now depend on a socialistic form of government bailouts, and others, like Italy, have capitalism without capitals.

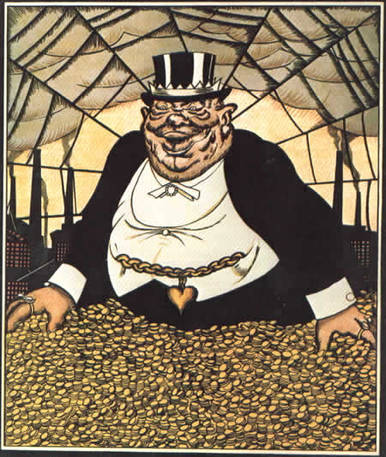

Recently, The New York Times seemed really surprised to find out that unregulated capitalism is selfish (“Give Him Liberty, but Not a Bailout,” NYT, 08/02). We know that Communism is good in theory, but it doesn’t work. We also know that capitalism, without rules and regulations, is not only selfish, but self-destructive. A true capitalist would indeed sell the rope with which he’s to be hanged.

Do we really believe that bankers, financiers and speculators have the common good in mind? Do we really expect oil companies to worry about a nation’s well being? Can we imagine currency traders being concerned about a country’s balance of payments? Of course not! They all follow Ayn Rand’s philosophy of celebrating the virtue of selfishness at the expense of the masses (after all, fortunes amassed have to come from somewhere!). Plus, with multinationals roaming freely, the well being of a nation cannot be considered even if one wanted to, since multinationals are not bound to any particular country and their only allegiance is to profits.

The U.S. has the good fortune of having strong liability laws, which compensate for the lack of government leadership. Thus, car manufactures tend to make safer automobiles only for fear of lawsuits. Similarly, oil companies avoid spills (when they cannot cover them up) out of a similar fear, and not for the good of the people, which inherently goes against profit maximization.

To followers of Rand, Leo Strauss and the Chicago School of Economics, abusing citizens and consumers is a form of philosophy. No common sense or logic can change their minds. They can even twist facts and call the deregulations that they themselves advocated and paid for “misregulation.” Once bailed out, followers of Rand might now say that banks didn’t need the bailout. How do they know? After all they were wrong before. They’ve ignored the devastating effect deregulation had on the entertainment and communications businesses, the transport industry, the utility sector, the banking industry, even the toy industry.

But let’s not blame them. They’re purely a product of an anarchist’s laissez-faire system. If a social-political system is strong, capitalism is the best way to assure general wealth. Regulations allow for all to start fair and square, without favoring bullies and without shortcuts, corruption or unfair practices. Under these circumstances, meritocracy is what makes the difference, not bribes and cover ups.

There are other variations of capitalism, and Italy epitomizes one of them: Capitalism without capitals. In Italy, anyone with little or no money, but with sufficient political clout, can acquire anything with government capital, as Alitalia, Telecom Italia and others can attest. Indeed, the state finances everything, from movies to newspapers, agriculture to cars, heath care to banks. The only capitalist element is that while losses are covered by the state, profits are only shared among those private partners that are politically well connected.

When the late Gianni Agnelli of the automaker FIAT announced that he was “donating” his art collection to the state, the underlying truth was that he was returning it to the state.

The commonality of Italy’s version of capitalism with its American form, is the “selfish” element, which has expanded to all levels of the Italian society. The state licenses every enterprise, so that licensees can better practice this “selfish” aspect of capitalism. Thus there are, for example, pharmacies and supermarkets closed when most needed by consumers and open only when convenient to the owners. The license requirement assures that stores cannot be put out of business by service-minded entrepreneurs.

In Italy, to make sure that transparency and ethic will not interfere with its version of capitalism, the regulated are also the regulators, i.e., bankers regulate banking (BankItalia) and speculators regulate the stock market (Consob).

But the best and most ingenious element of Italy’s form of “selfish” capitalism is the crisscross responsibility which assures that no one can ever be blamed for any wrong doing, as most recently demonstrated with the train wreck in Viareggio that killed 28 people with gross negligence that no-one could be blamed for. #

Source URL: http://ftp.iitaly.org/magazine/focus/op-eds/article/capitalism-without-capitals

Links

[1] http://ftp.iitaly.org/files/capitalist1250752632jpg

[2] http://www.domserafini.net

[3] http://www.videoage.org